Angélica Marrero

To view changing data, hover over or touch the animated graphic below.

To view changing data, hover over or touch the animated graphic below.

To view changing data, hover over or touch the animated graphic below.

To view changing data, hover over or touch the animated graphic below.U.S. Exports

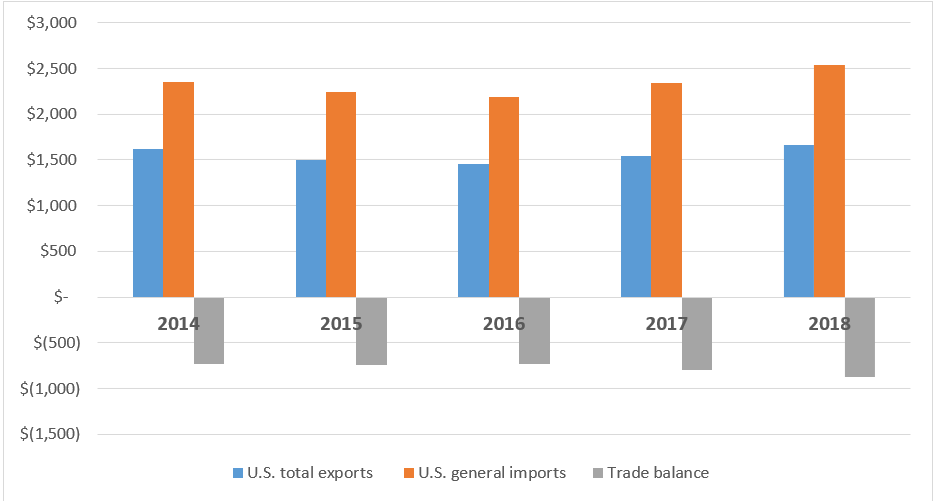

In 2018, U.S. total exports and general imports both increased.[1] General imports increased at a higher rate, reaching their highest levels since 2014 (table US.1), while U.S. total exports rose by $117 billion (7.6 percent) to nearly $1.7 trillion from 2017 to 2018. This was the second year in a row of export growth, after two years of declining exports in 2015 and 2016. All 10 major merchandise sectors experienced aggregate increases in U.S. total exports in 2018. Energy-related products showed the largest increase in U.S. total exports in terms of value, mostly due to an increase in export prices, while export volumes experienced a relatively small increase; specifically, the value of U.S. exports of energy-related products rose $51.6 billion (35.7 percent) in 2018. The value of U.S. exports of chemicals and related products, as well as transportation equipment, posted the next-largest gains in 2018, growing by $15.7 billion (7.0 percent) and $12.4 billion (3.8 percent), respectively. Combined, these three sectors accounted for over one-third of the growth in the value of U.S. total exports in 2018 (table US.1). (For more information, see the Energy-related Products, Chemicals and Related Products, and Transportation Equipment chapters.)

Table US.1 U.S. total exports, general imports, and merchandise trade balance, by major industry/commodity sectors, 2014–18

|

Million $

|

|||||||

|---|---|---|---|---|---|---|---|

|

Item |

2014

|

2015

|

2016

|

2017

|

2018

|

Absolute change,

2017–18

|

Percent

change,

2017–18

|

| U.S. total exports: |

|

||||||

|

Agricultural products |

164,429 |

146,630 |

148,626 |

152,965 |

154,944 |

1,979 |

1.3 |

|

Forest products |

41,169 |

39,060 |

37,700 |

39,592 |

40,862 |

1,270 |

3.2 |

|

Chemicals and related products |

235,020 |

227,669 |

217,979 |

227,526 |

243,436 |

15,910 |

7.0 |

|

Energy-related products |

161,755 |

110,379 |

98,489 |

144,319 |

195,897 |

51,578 |

35.7 |

|

Textiles and apparel |

23,985 |

23,300 |

21,734 |

22,146 |

22,712 |

565 |

2.6 |

|

Footwear |

1,456 |

1,464 |

1,367 |

1,432 |

1,559 |

127 |

8.8 |

|

Minerals and metals |

152,910 |

135,667 |

128,680 |

136,447 |

146,274 |

9,827 |

7.2 |

|

Machinery |

145,981 |

138,859 |

128,183 |

136,204 |

143,279 |

7,075 |

5.2 |

|

Transportation equipment |

336,439 |

327,374 |

320,006 |

325,578 |

337,942 |

12,364 |

3.8 |

|

Electronic products |

267,833 |

264,121 |

260,426 |

268,546 |

276,896 |

8,350 |

3.1 |

|

Miscellaneous manufactures |

47,636 |

47,363 |

47,702 |

49,081 |

52,096 |

3,015 |

6.1 |

|

Special provisions |

43,260 |

41,444 |

40,131 |

42,437 |

48,160 |

5,723 |

13.5 |

|

Total |

1,621,874 |

1,503,328 |

1,451,024 |

1,546,273 |

1,664,056 |

117,783 |

7.6 |

|

U.S. general imports: |

|

|

|

|

|

|

|

|

Agricultural products |

136,341 |

136,958 |

139,132 |

147,359 |

156,615 |

9,256 |

6.3 |

|

Forest products |

42,213 |

42,390 |

43,115 |

44,822 |

48,696 |

3,874 |

8.6 |

|

Chemicals and related products |

251,529 |

260,444 |

259,893 |

268,134 |

311,213 |

43,079 |

16.1 |

|

Energy-related products |

351,626 |

194,132 |

157,784 |

197,931 |

236,366 |

38,435 |

19.4 |

|

Textiles and apparel |

121,688 |

126,535 |

120,231 |

121,372 |

127,663 |

6,291 |

5.2 |

|

Footwear |

26,018 |

27,650 |

25,634 |

25,640 |

26,567 |

927 |

3.6 |

|

Minerals and metals |

205,500 |

189,262 |

183,551 |

200,580 |

215,285 |

14,706 |

7.3 |

|

Machinery |

185,529 |

185,926 |

179,487 |

196,320 |

214,658 |

18,338 |

9.3 |

|

Transportation equipment |

404,024 |

426,421 |

418,314 |

434,862 |

459,727 |

24,864 |

5.7 |

|

Electronic products |

439,109 |

449,879 |

449,861 |

484,129 |

506,070 |

21,942 |

4.5 |

|

Miscellaneous manufactures |

114,391 |

124,791 |

124,879 |

130,350 |

139,036 |

8,686 |

6.7 |

|

Special provisions |

78,388 |

84,424 |

85,718 |

90,462 |

100,836 |

10,374 |

11.5 |

|

Total |

2,356,356 |

2,248,811 |

2,187,600 |

2,341,963 |

2,542,733 |

200,771 |

8.6 |

|

U.S. merchandise trade balance: |

|

|

|

|

|

|

|

|

Agricultural products |

28,088 |

9,672 |

9,494 |

5,606 |

-1,671 |

-7,277 |

(a) |

|

Forest products |

-1,044 |

-3,330 |

-5,414 |

-5,230 |

-7,834 |

-2,604 |

-49.8 |

|

Chemicals and related products |

-16,509 |

-32,775 |

-41,914 |

-40,608 |

-67,776 |

-27,169 |

-66.9 |

|

Energy-related products |

-189,871 |

-83,753 |

-59,295 |

-53,613 |

-40,470 |

13,143 |

24.5 |

|

Textiles and apparel |

-97,702 |

-103,235 |

-98,498 |

-99,226 |

-104,952 |

-5,726 |

-5.8 |

|

Footwear |

-24,562 |

-26,186 |

-24,267 |

-24,208 |

-25,009 |

-800 |

-3.3 |

|

Minerals and metals |

-52,591 |

-53,596 |

-54,871 |

-64,133 |

-69,012 |

-4,879 |

-7.6 |

|

Machinery |

-39,549 |

-47,068 |

-51,305 |

-60,117 |

-71,379 |

-11,263 |

-18.7 |

|

Transportation equipment |

-67,584 |

-99,047 |

-98,308 |

-109,284 |

-121,785 |

-12,501 |

-11.4 |

|

Electronic products |

-171,276 |

-185,758 |

-189,435 |

-215,583 |

-229,174 |

-13,591 |

-6.3 |

|

Miscellaneous manufactures |

-66,755 |

-77,427 |

-77,176 |

-81,269 |

-86,940 |

-5,672 |

-7.0 |

|

Special provisions |

-35,128 |

-42,980 |

-45,587 |

-48,026 |

-52,676 |

-4,650 |

-9.7 |

|

Total |

-734,482 |

-745,483 |

-736,577 |

-795,690 |

-878,678 |

-82,988 |

-10.4 |

Source: Compiled from official statistics of the U.S. Department of Commerce.

Note: Import values are based on U.S. customs value; export values are based on free alongside ship value, U.S. port of export. Calculations are based on unrounded data. The industry/commodity sector order shown above reflects the order of commodities in the Harmonized Tariff Schedule. Please refer to Resources: Industry/Commodity Groups

a The size of the change was not meaningful for purposes of comparison.

Figure US.1 Total U.S. exports, general imports and trade balance, 2014–18 (billion $)

Source: USITC DataWeb/USDOC (accessed March 15, 2019).

Although all sectors experienced growth in the value of their exports, some product groups within the sectors experienced a decline, lessening the overall sectoral gains. For example, exports of transportation equipment saw an increase of $12.4 billion (3.8 percent) in 2018. However, this increase was tempered by a decrease in exports of two product groups within this sector—motor vehicles[2] (down $1.2 billion, or 1.5 percent) and aircraft engines and gas turbines[3] (down $766 million, or 7.7 percent) (table US.2).

U.S. exports of agricultural products experienced the smallest aggregate increase in 2018. Among the agricultural products that saw increases were cereals ($2.4 billion, 13.1 percent),[4] animal feeds ($2.0 billion, 16.7 percent),[5] and cattle and beef ($1.1 billion, 15.2 percent).[6] However, the drop in exports of U.S. oilseeds (down $4.3 billion, or 19.9 percent) partly offset the gains in exports of other agricultural products. (For more information, see the Agricultural Products chapter.)

Table US.2 All merchandise sectors: Leading changes in U.S. exports and imports, 2014–18

|

Million $

|

|||||||

|---|---|---|---|---|---|---|---|

|

Item |

2014

|

2015

|

2016

|

2017

|

2018

|

Absolute change,

2017–18

|

Percent

change,

2017–18

|

| U.S. total exports: |

|

||||||

|

Increases: |

|

|

|

|

|

|

|

|

Crude petroleum (EP004) |

12,219 |

8,821 |

9,380 |

22,594 |

47,190 |

24,597 |

108.9 |

|

Petroleum products (EP005) |

119,712 |

80,734 |

68,562 |

85,713 |

103,847 |

18,135 |

21.2 |

|

Aircraft, spacecraft, and related equipment (TE013) |

124,214 |

129,414 |

131,954 |

129,603 |

138,034 |

8,431 |

6.5 |

|

Natural gas and components (EP006) |

17,885 |

12,001 |

13,895 |

23,585 |

29,945 |

6,360 |

27.0 |

|

Medicinal chemicals (CH019) |

54,717 |

58,466 |

56,991 |

55,361 |

59,288 |

3,926 |

7.1 |

|

Decreases: |

|

|

|

|

|

|

|

|

Oilseeds (AG032) |

24,247 |

19,175 |

23,164 |

21,785 |

17,448 |

-4,337 |

-19.9 |

|

Telecommunications equipment (EL002) |

38,938 |

40,834 |

40,065 |

38,681 |

36,598 |

-2,083 |

-5.4 |

|

Motor vehicles (TE009) |

77,763 |

70,436 |

69,651 |

71,440 |

70,375 |

-1,065 |

-1.5 |

|

Steel mill products (MM025) |

17,069 |

13,713 |

11,608 |

13,502 |

12,547 |

-954 |

-7.1 |

|

Aircraft engines and gas turbines (TE001) |

10,729 |

10,991 |

10,539 |

9,995 |

9,229 |

-766 |

-7.7 |

|

All other |

1,124,382 |

1,058,744 |

1,015,215 |

1,074,015 |

1,139,554 |

65,539 |

6.1 |

|

Total |

1,621,874 |

1,503,328 |

1,451,024 |

1,546,273 |

1,664,056 |

117,783 |

7.6 |

|

U.S. general imports: |

|

|

|

|

|

|

|

|

Increases: |

|

|

|

|

|

|

|

|

Crude petroleum (EP004) |

246,969 |

126,073 |

101,845 |

133,193 |

157,353 |

24,160 |

18.1 |

|

Medicinal chemicals (CH019) |

93,436 |

109,778 |

113,195 |

112,215 |

136,200 |

23,985 |

21.4 |

|

Petroleum products (EP005) |

79,764 |

51,513 |

41,130 |

48,522 |

62,742 |

14,220 |

29.3 |

|

Computers, peripherals, and parts (EL017) |

121,512 |

119,620 |

112,561 |

124,073 |

138,092 |

14,019 |

11.3 |

|

Certain motor-vehicle parts (TE010) |

82,106 |

86,139 |

85,865 |

85,225 |

91,166 |

5,941 |

7.0 |

|

Decreases: |

|

|

|

|

|

|

|

|

Telecommunications equipment (EL002) |

98,289 |

105,055 |

107,863 |

116,116 |

111,973 |

-4,143 |

-3.6 |

|

Coffee and tea (AG028) |

6,954 |

6,927 |

6,621 |

7,215 |

6,619 |

-596 |

-8.3 |

|

All other |

1,627,326 |

1,643,707 |

1,618,520 |

1,715,405 |

1,838,588 |

123,183 |

7.2 |

|

Total |

2,356,356 |

2,248,811 |

2,187,600 |

2,341,963 |

2,542,733 |

200,771 |

8.6 |

Source: Compiled from official statistics of the U.S. Department of Commerce.

Note: Import values are based on U.S. customs value; export values are based on free alongside ship value, U.S. port of export. Calculations are based on unrounded data.

U.S. Imports

The value of U.S. general imports increased for the 10 merchandise sectors included in the report, rising a combined $200.8 billion (8.6 percent) to $2.5 trillion from 2017 to 2018. The largest increase in value occurred in the chemicals and related products sector, which gained $43.1 billion (16.1 percent). The medicinal chemicals product group drove the increase in U.S. imports in this sector, gaining $24.0 billion (21.4 percent) and accounting for about 56 percent of the sectoral increase. Energy-related products and transportation equipment experienced the second- and third-largest increase in U.S. general imports, rising $38.4 billion (19.4 percent) and $24.9 billion (5.7 percent), respectively (table US.1). Combined, these three sectors accounted for about 53 percent of the total value increase in U.S. general imports during this period. U.S. imports of footwear increased the least in both absolute and percentage terms, growing $927 million (3.6 percent) from 2017 to 2018. Nonetheless, this increase is far larger than the $6 million increase in footwear imports from 2016 to 2017.[7]

In contrast, some product groups experienced a decline in import values. The largest declines were in U.S. imports of two main product groups: telecommunications equipment, down $4.1 billion (3.6 percent), and coffee and tea, down $596 million (8.3 percent) (table US.2). (For more information, see the Transportation Equipment and Agricultural Products chapters.)

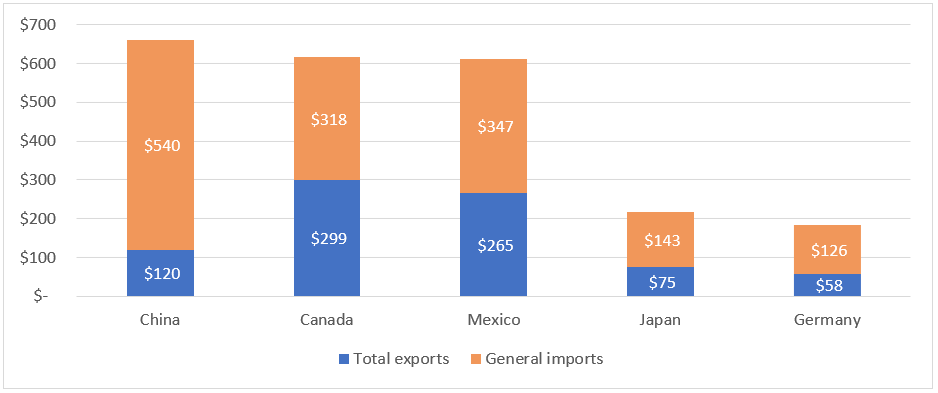

Trade with Major Trading Partners

China, Canada, and Mexico continued to be the top U.S. trading partners in 2018 (figure US.2).[8] China continued to be the main supplier for U.S. imports of merchandise and was the third leading destination for U.S. exports. The largest destination for U.S. exports, however, was the bloc comprising the United States’ North American trading partners, Canada and Mexico. Combined, U.S. exports to these two countries accounted for one-third of all U.S. exports of merchandise in 2018. Japan and Germany ranked fourth and fifth, respectively, both as suppliers for U.S. imports and as destinations for U.S. exports (table US.3).

Figure US.2 Total trade between the United States and its five largest single-country trading partners, 2018 (billion $)

Source: USITC DataWeb/USDOC (accessed March 15, 2019).

U.S. Exports to Major Trading Partners

While the value of U.S. exports to China decreased by $9.6 billion (7.4 percent) from 2017 to 2018, the value of exports to Canada and Mexico increased over the same period, gaining $16.5 billion (5.8 percent) and $21.7 billion (8.9 percent), respectively. The decrease in U.S. exports to China was driven by a sharp drop in exports of oilseeds,[9] which were $9.1 billion (74 percent) lower than in 2017. [10] (For more information about oilseeds exports to China, see the Agricultural Products and Special Topic chapters.)

The increase in U.S. exports to Canada was led by gains in both the volume and the average price of crude petroleum[11] and petroleum products.[12] In 2018, the leading changes in exports to Mexico were higher value and quantity of U.S. exports of petroleum products[13] and an increase in export values of certain motor-vehicle parts.[14] Exports of U.S. merchandise to other major trading partners such as Japan, Germany, South Korea, and the United Kingdom also experienced gains over the previous year (table US.3).

At the sector level, the increases in U.S. exports were led by three product sectors: energy-related products, transportation equipment, and chemical products. Higher exports of energy-related products in 2018, such as crude petroleum (up $24.6 billion, or 108.9 percent), petroleum products ($18.1 billion, 21.2 percent), and natural gas ($6.4 billion, 27.0 percent), reflected an increase in both the value and the volume of exports.[15] The main markets for U.S. exports of these products were major U.S. trading partners, including Canada and Mexico, as well as markets such as Taiwan and India. Similarly, U.S. exports of transportation equipment—particularly aircraft, spacecraft, and related equipment ($8.4 billion, 6.5 percent)—went mostly to the United Kingdom, China, France, and Germany. The growth in exports of medicinal chemicals ($3.9 billion, 7.1 percent) was mostly due to increases in exports to European countries, particularly Italy, Germany, the Netherlands, Belgium, and the United Kingdom. (For more information, see the Energy-related Products, Transportation Equipment, and Chemicals and Related Products chapters.)

The increase in overall U.S. exports of merchandise was somewhat offset by a drop in the value of exports in several sectors. In particular, exports of oilseeds dropped $4.3 billion (19.9 percent), driven by a reduction in exports to China (table US.2). U.S. exports of telecommunications equipment decreased $2.1 billion (5.4 percent) due to a decline in exports to France, Hong Kong, and Spain. At the same time, exports of motor vehicles were down $1.1 billion (1.5 percent), resulting from a substantial decrease in exports to China. Further, U.S. exports of steel mill products were $954 million (7.1 percent) lower in 2018 than in 2017, driven by lower exports to Canada and Mexico. Meanwhile, U.S. exports of aircraft engines and gas turbines declined $766 million (7.7 percent), a decrease that was led by lower exports to countries including Saudi Arabia, Hungary, Singapore, and Canada. (For more information, see the Agricultural Products, Electronic Products, Transportation Equipment, and Minerals and Metals chapters.)

U.S. Imports from Major Trading Partners

The value of U.S. general imports of merchandise from all major trading partners increased from 2017 to 2018. The three top markets for U.S. exports—China, Canada, and Mexico—were also the top three suppliers of merchandise to the United States. Imports from these three countries saw the largest increases during this period and accounted for about 42 percent of the total increase in the value of U.S. general imports. U.S. imports from China rose the most, gaining $34.0 billion (6.7 percent) in 2018 to reach $539 billion, the highest level in the last five years. The next largest suppliers of merchandise to the United States were Mexico and Canada, accounting for 26 percent of the total imports in 2018. Imports from Mexico rose $32.3 billion (10.3 percent), while imports from Canada grew by $19.2 billion (6.4 percent) in the same period (table US.3).

The increase in U.S. imports from China was led by increases in imports of computers, peripherals, and parts;[16] toys and games;[17] and miscellaneous plastic products.[18] These increases were partially offset by decreases in imports of telecommunications equipment;[19] semiconductors and integrated circuits;[20] blank and prerecorded media;[21] and aluminum mill products.[22] The increase in U.S. general imports from Canada was led by imports of crude petroleum[23] and motor vehicles,[24] which were at their highest levels in the last five years. This increase in U.S. imports from Canada was partially offset by a decrease in imports of motor vehicles,[25] lumber,[26] and precious metals and non-numismatic coins.[27] The growth in U.S. imports from Mexico was largely driven by a combined $18.3 billion increase in imports of computers, peripherals, and parts;[28] crude petroleum;[29] and motor vehicles.[30] These increases in U.S. imports from Mexico were partially offset by a decrease in imports of consumer electronics[31] and motor vehicles.[32]

At the sector level, U.S. imports of merchandise in 2018, like U.S. exports, were concentrated in the energy-related products, chemicals, and transportation equipment sectors (table US.1). Imports of energy-related products—particularly crude petroleum, petroleum products, and natural gas and components—were mostly sourced from Canada and Mexico, as well as from three other key exporters of energy-related products: Saudi Arabia, Russia, and Venezuela. Similarly, the United States’ imports of transportation equipment came mostly from major trading partners that are also large exporters of transportation equipment—Mexico, Japan, Canada, Germany, South Korea, and China. Those six countries together supplied about half of the total U.S. imports within this sector. (For more information, see the Energy-related Products, Transportation Equipment, and Chemicals and Related Products chapters.)

The overall increase in the value of U.S. imports of merchandise was somewhat offset by decreases in imports of telecommunications equipment, which fell $4.1 billion (3.6 percent) in 2018 (table US.2), especially with respect to three Asian trading partners—Malaysia, Taiwan, and Thailand—as well as from Mexico. In addition, U.S. imports of coffee and tea decreased $596 million (8.3 percent), driven by lower imports of these products from Canada, Vietnam, Colombia, and Brazil. (For more information, see the Electronic Products and Agricultural Products chapters.)

Table US.3 All merchandise sectors: U.S. total exports, general imports, and merchandise trade balance, by selected trading partners and groups, 2014–18

|

Million $

|

|||||||

|---|---|---|---|---|---|---|---|

|

Item |

2014

|

2015

|

2016

|

2017

|

2018

|

Absolute change,

2017–18

|

Percent

change,

2017–18

|

| U.S. total exports: |

|

||||||

|

China |

123,657 |

115,873 |

115,546 |

129,894 |

120,341 |

-9,552 |

-7.4 |

|

Canada |

312,817 |

280,855 |

266,734 |

282,265 |

298,719 |

16,454 |

5.8 |

|

Mexico |

241,007 |

236,460 |

230,051 |

243,314 |

265,010 |

21,696 |

8.9 |

|

Japan |

66,892 |

62,388 |

63,226 |

67,605 |

74,967 |

7,362 |

10.9 |

|

Germany |

49,419 |

49,979 |

49,432 |

53,897 |

57,654 |

3,757 |

7.0 |

|

South Korea |

44,650 |

43,484 |

42,313 |

48,326 |

56,344 |

8,018 |

16.6 |

|

United Kingdom |

53,913 |

56,095 |

55,169 |

56,258 |

66,228 |

9,970 |

17.7 |

|

France |

31,289 |

30,026 |

31,153 |

33,596 |

36,326 |

2,731 |

8.1 |

|

India |

21,499 |

21,453 |

21,636 |

25,689 |

33,120 |

7,431 |

28.9 |

|

Italy |

16,969 |

16,212 |

16,724 |

18,405 |

23,153 |

4,749 |

25.8 |

|

All other |

659,762 |

590,503 |

559,039 |

587,025 |

632,192 |

45,167 |

7.7 |

|

Total |

1,621,874 |

1,503,328 |

1,451,024 |

1,546,273 |

1,664,056 |

117,783 |

7.6 |

|

EU-28 |

276,274 |

271,911 |

269,549 |

283,269 |

318,619 |

35,350 |

12.5 |

|

OPEC |

83,525 |

73,243 |

65,313 |

59,305 |

58,897 |

-408 |

-0.7 |

|

Latin America |

424,852 |

389,039 |

365,827 |

393,509 |

428,792 |

35,283 |

9.0 |

|

Asia |

407,186 |

385,404 |

383,361 |

421,440 |

446,194 |

24,754 |

5.9 |

|

Sub-Saharan Africa |

25,491 |

18,005 |

13,481 |

14,063 |

15,843 |

1,780 |

12.7 |

|

U.S. general imports: |

|

|

|

|

|

|

|

|

China |

468,475 |

483,202 |

462,542 |

505,470 |

539,503 |

34,033 |

6.7 |

|

Canada |

349,286 |

296,305 |

277,782 |

299,319 |

318,481 |

19,162 |

6.4 |

|

Mexico |

295,730 |

296,433 |

293,924 |

314,267 |

346,528 |

32,260 |

10.3 |

|

Japan |

134,505 |

131,445 |

132,030 |

136,481 |

142,596 |

6,115 |

4.5 |

|

Germany |

124,182 |

124,888 |

114,107 |

117,575 |

125,904 |

8,329 |

7.1 |

|

South Korea |

69,677 |

71,775 |

69,895 |

71,444 |

74,291 |

2,846 |

4.0 |

|

United Kingdom |

54,689 |

58,057 |

54,271 |

53,060 |

60,812 |

7,752 |

14.6 |

|

France |

47,105 |

47,809 |

46,718 |

48,899 |

52,522 |

3,623 |

7.4 |

|

India |

45,358 |

44,783 |

46,028 |

48,603 |

54,407 |

5,805 |

11.9 |

|

Italy |

42,378 |

44,221 |

45,292 |

49,918 |

54,722 |

4,805 |

9.6 |

|

All other |

724,971 |

649,894 |

645,011 |

696,926 |

772,966 |

76,040 |

10.9 |

|

Total |

2,356,356 |

2,248,811 |

2,187,600 |

2,341,963 |

2,542,733 |

200,771 |

8.6 |

|

EU-28 |

420,609 |

427,810 |

416,393 |

434,633 |

487,916 |

53,283 |

12.3 |

|

OPEC |

133,423 |

66,741 |

58,561 |

72,193 |

79,810 |

7,617 |

10.6 |

|

Latin America |

445,985 |

412,338 |

401,583 |

430,267 |

468,816 |

38,550 |

9.0 |

|

Asia |

914,154 |

943,728 |

927,949 |

993,980 |

1,061,411 |

67,431 |

6.8 |

|

Sub-Saharan Africa |

26,785 |

18,849 |

20,141 |

24,865 |

25,078 |

213 |

0.9 |

Source: Compiled from official statistics of the U.S. Department of Commerce.

Note: Import values are based on U.S. customs value; export values are based on free alongside ship value, U.S. port of export. Calculations are based on unrounded data.

U.S. Trade Balance

The U.S. merchandise trade deficit with the rest of the world grew by $83.0 billion (10.4 percent) to $878.7 billion in 2018. This amount of deficit growth surpassed the deficit increase of 2017, reached the highest absolute level of growth, and attained the highest yearly growth from 2014 to 2018 (table US.1). In 2018, the United States experienced a trade deficit in all 10 merchandise sectors included in this report—including agricultural products, which had had a trade surplus during each of the previous four years from 2014 to 2017.

The United States did not experience deficit growth in all merchandise sectors. In fact, the trade deficit in energy-related products continued to fall in 2018, as it had during 2014–17, declining 13.1 billion (24.5 percent) from the previous year. In the remaining sectors, however, the trade deficit widened. In particular, it grew by $27.2 billion (66.9 percent) for chemicals and related products––the largest increase in 2018. The trade deficits for electronic products ($13.6 billion, 6.3 percent) and transportation equipment ($12.5 billion, 11.4 percent) increased by the second- and third-largest dollar amounts, respectively, from 2017 to 2018 (table US.1). In 2018, despite making up about half of the value of total U.S. exports that year, these three sectors combined contributed two-thirds of the total increase in the U.S. trade deficit in 2018.

In 2018, the United States had trade deficits with all of its major trading partners except the United Kingdom, and the trade deficit expanded with six of the United States’ top 10 partners. It increased the most in value with China, expanding by $43.6 billion (11.6 percent). It also increased with Canada and Mexico, rising $2.7 billion (15.9 percent) and $10.6 billion (14.9 percent), respectively. On the other hand, the U.S. trade deficit with Japan, South Korea, and India in 2018 decreased by $1.2 billion (1.8 percent), $5.1 billion (22.4 percent), and $1.6 billion (7.1 percent), respectively.

[1] Unless otherwise noted, the export data used in this investigation are for domestic exports. For more information on trade terminology, please refer to USITC, “Special Topic: Trade Metrics,” Shifts in U.S. Merchandise Trade, 2014, 2015, https://www.usitc.gov/research_and_analysis/trade_shifts_2014/trade_metrics.htm.

[2] USITC DataWeb/USDOC, digest TE009 (accessed March 15, 2019).

[3] USITC DataWeb/USDOC, digest TE001 (accessed March 15, 2019).

[4] USITC DataWeb/USDOC, digest AG030 (accessed March 15, 2019).

[5] USITC DataWeb/USDOC, digest AG013 (accessed March 15, 2019).

[6] USITC DataWeb/USDOC, digest AG002 (accessed March 15, 2019).

[7] See the Energy-related Products, Chemicals and Related Products, Transportation Equipment, and Footwear chapters included in this report for more information.

[8] In 2018, China, Canada, and Mexico, combined, accounted for 45 percent of the total U.S. trade. In 2017, these countries accounted for 46 percent of the total U.S. trade. USITC DataWeb/USDOC (accessed March 15, 2019).

[9] USITC DataWeb/USDOC, digest AG032 (accessed March 15, 2019). For more information, see the Agricultural products chapter in this report.

[10] U.S. exports of soybeans (HTS 1201.90.0095) led the decrease in exports of oilseeds to China.

[11] USITC DataWeb/USDOC, digest EP004 (accessed March 15, 2019).

[12] USITC DataWeb/USDOC, digest EP005 (accessed March 15, 2019).

[13] USITC DataWeb/USDOC, digest EP005 (accessed March 15, 2019).

[14] USITC DataWeb/USDOC, digest TE010 (accessed March 15, 2019).

[15] IHS Markit, Global Trade Atlas database (HS subheadings 2709, 2010, and 2011, accessed July 30, 2019).

[16] USITC DataWeb/USDOC, digest EL017 (accessed March 15, 2019).

[17] USITC DataWeb/USDOC, digest MS009 (accessed March 15, 2019).

[18] USITC DataWeb/USDOC, digest CH033 (accessed March 15, 2019).

[19] USITC DataWeb/USDOC, digest EL002 (accessed March 15, 2019).

[20] USITC DataWeb/USDOC, digest EL015 (accessed March 15, 2019).

[21] USITC DataWeb/USDOC, digest EL004 (accessed March 15, 2019).

[22] USITC DataWeb/USDOC, digest MM038 (accessed March 15, 2019).

[23] USITC DataWeb/USDOC, digest EP004 (accessed March 15, 2019).

[24] USITC DataWeb/USDOC, digest TE009 (accessed March 15, 2019).

[25] USITC DataWeb/USDOC, digest TE009 (accessed March 15, 2019).

[26] USITC DataWeb/USDOC, digest FP002 (accessed March 15, 2019).

[27] USITC DataWeb/USDOC, digest MM020 (accessed March 15, 2019).

[28] USITC DataWeb/USDOC, digest EL017 (accessed March 15, 2019).

[29] USITC DataWeb/USDOC, digest EP004 (accessed March 15, 2019).

[30] USITC DataWeb/USDOC, digest TE009 (accessed March 15, 2019).

[31] USITC DataWeb/USDOC, digest EL003 (accessed March 15, 2019).

[32] USITC DataWeb/USDOC, digest TE009 (accessed March 15, 2019).