Author: Kathryn Lundquist

International Trade Analyst

Introduction

U.S. merchandise trade is an increasingly complex system of imports and exports. As international supply chains and the use of foreign-trade zones (FTZs) become more and more prevalent, understanding how intermediate and finished goods enter and leave the United States, along with the characteristics of the available metrics, is vital to accurately analyzing U.S. trade data. The discussion in this webpage will first briefly look at available U.S. trade statistics. This will be followed by descriptions of U.S. FTZs and re-exports. The discussion will conclude with a fuller explanation of the effects of FTZs and re-exports on U.S. trade statistics.

U.S. Trade Statistics

The five broad trade metrics gathered by the U.S. Census are defined in box ST.1, and trade data for these metrics are presented in tables ST.1 and ST.2. These data are aggregated from importers’ and exporters’ self-reported filings, including the traded item(s)’ U.S. Harmonized Tariff Schedule or Schedule B number1 for all shipments above a specified value.2

Box ST.1: Definitions of the Five Broad Metrics Gathered by U.S. Census

General imports are total physical arrivals of merchandise from foreign countries into the United States, whether such merchandise enters consumption channels immediately or is entered into bonded warehouses or FTZs under Customs custody. In 2014, U.S. general imports were valued at $2.35 trillion (see table ST.1).

Imports for consumption (sometimes called “special imports”) are merchandise that has physically cleared through Customs, either entering consumption channels immediately or entering for consumption after withdrawal from bonded warehouses or FTZs under Customs custody. In 2014, the value of U.S. imports for consumption was $2.31 trillion—slightly less than the U.S. general imports just discussed—due to merchandise being retained in bonded warehouses, retained in FTZs, further processed in FTZs, or inventoried and later re-exported.

Domestic exports are (1) exported goods that were grown, produced, or manufactured in the United States, and (2) exported commodities of foreign origin that have been changed in the United States (including changes made in a U.S. FTZ) from the form in which they were imported, or that have been enhanced in value or improved in condition by further processing or manufacturing in the United States. In 2014, domestic exports were valued at $1.4 trillion. This is significantly less than total exports (see below), a category that includes re-exports (see table ST.2).

Re-exports (foreign exports) are exports of goods of foreign origin that (1) have previously entered the U.S. customs territory, a Customs bonded warehouse, or a U.S. FTZ, and (2) at the time of exportation, have not undergone any substantial change in form or condition or any enhancement in value by further manufacturing in the U.S. customs territory or U.S. FTZs. In 2014, re-exports were valued at $221.2 billion.

Total exports are U.S. domestic exports plus re-exports. This includes all exports of physical merchandise from the United States. In 2014, the value of U.S. total exports was $1.6 trillion.a

a USDOC, Census webpage, “Trade Definitions,” https://www.census.gov/foreign-trade/reference/definitions/ (accessed March 25, 2015); USITC, “A Note on U.S. Trade Statistics,” August 22, 2014. Census also notes the following definition for re-exports (“foreign exports”): “Exports of foreign merchandise (re-exports) consist of commodities of foreign origin which have entered the United States for consumption, or into Customs bonded warehouses or U.S. Foreign Trade Zones, and which, at the time of exportation, are in substantially the same condition as when imported.” USDOC, Census, “Guide to Foreign Trade Statistics” (accessed March 25, 2015).

| Item |

2010

|

2011

|

2012

|

2013

|

2014

|

|---|---|---|---|---|---|

| U.S. general imports | 1,913,856.60 | 2,207,954.30 | 2,276,302.30 | 2,268,321.30 | 2,345,187.10 |

| Entered into an FTZ or bonded warehouse | 228,821 | 302,335 | 303,428 | 286,798 | 293,022 |

| FTZ share of general imports | 12 | 13.7 | 13.3 | 12.6 | 12.5 |

| U.S. imports for consumption | 1,900,587 | 2,187,994 | 2,251,808 | 2,241,442 | 2,313,960 |

| Admitted from an FTZ or bonded warehouse | 215,551 | 282,374 | 278,933 | 259,919 | 261,795 |

| FTZ share of imports for consumption | 11.3 | 12.9 | 12.4 | 11.6 | 11.3 |

| Imports for consumption as a share of general imports (percent) | 99% | 99% | 99% | 99% | 99% |

| Item |

2010

|

2011

|

2012

|

2013

|

2014

|

|---|---|---|---|---|---|

| Total exports | 1,278,495 | 1,482,508 | 1,545,703 | 1,579,593 | 1,623,443 |

| Domestic exports | 1,122,567 | 1,300,125 | 1,352,140 | 1,371,432 | 1,402,273 |

| Re-exports (foreign exports) | 155,927 | 182,383 | 193,563 | 208,161 | 221,170 |

| Re-exports' share of total | 12% | 12% | 13% | 13% | 14% |

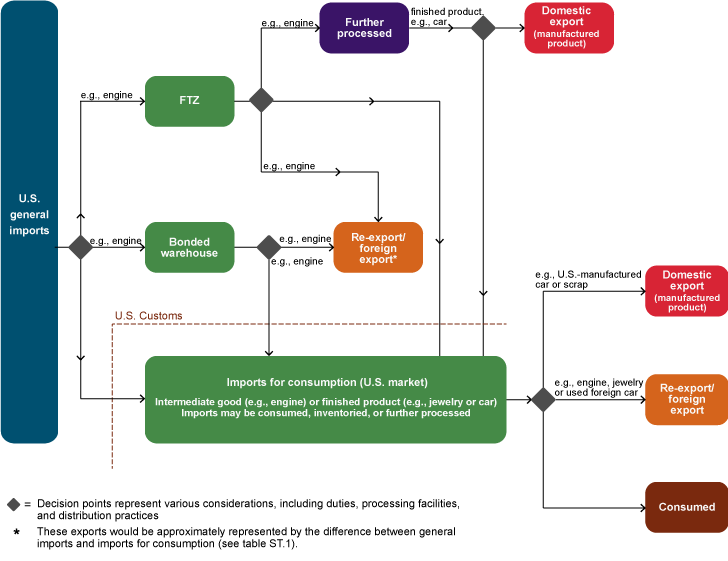

The difference between the value of U.S. general imports and U.S. imports for consumption has remained small over time (see table ST.1). Any import above a certain value that comes into a U.S. port of entry must have a form filed with Customs declaring the product, its quantity, its weight, and its value. It is recorded at this point as a U.S. general import. General imports may then proceed in one of three ways, illustrated in figure ST.1.

First, importers may pay a duty, if the item is not already duty-free, and bring the good into the U.S. customs territory, at which time it will be marked as a U.S. import for consumption. About 88 percent of U.S. general imports in 2014 entered immediately as U.S. imports for consumption. Second, the good may remain as a general import if guaranteed by a bond for the duties owed before the good is moved into a bonded warehouse. Once in a bonded warehouse, the good can remain for up to five years and undergo cleaning, sorting, packing, or anything other than manufacturing. Or third, the good may enter as a general import into an FTZ, without bond or duty, where it may be held for an unlimited amount of time and is permitted to undergo manufacturing operations.

If the good is further processed at an FTZ and then exported, it becomes a domestic export. If the good is cleared through Customs, regardless of processing, it is recorded as an import for consumption. (About 12 percent of U.S. general imports in 2014 did not immediately become imports for consumption because they were admitted into an FTZ or bonded warehouse; see table ST.1.) If it is not further worked, a good in any of these three categories of imports can be re-exported from the United States.

Re-exports have grown steadily in the past five years, but they are still small compared to domestic exports (their value was 14 percent of the value of total exports in 2014, compared to 12 percent in 2010). Firms exporting goods out of the United States must note whether a good was manufactured domestically or abroad, along with the item’s value, when they export a shipment. Total exports are the aggregate value of domestic exports and re-exports. A description of re-exports will form the bulk of the remaining discussion, followed by a list of caveats applicable to collected U.S. trade data.

Foreign Trade Zones

Although the overall share of FTZs in U.S. trade is limited, these zones have become an increasingly important source of U.S. re-exports, as both industry and government representatives attest. FTZs are enclosed areas, authorized by the U.S. FTZ Board and subject to Customs oversight, where imported merchandise can be handled, stored, manipulated, exhibited, and manufactured into downstream products. There were 177 active FTZs in 2013, up from 168 in 2010.3

Merchandise admitted into an FTZ may afterwards be exported, destroyed, or sent into the U.S. customs territory, which includes the states, the District of Columbia, and Puerto Rico, but excludes other FTZs and bonded warehouses. The merchandise is subject to Customs duties only if sent into the U.S. customs territory. Using an FTZ, a firm can import a good and warehouse it without paying for a bond or paying an import duty. The firm can then either re-export the good, import it unchanged into the United States for consumption, or further process it inside the FTZ.

From an importing firm’s cash-flow perspective, keeping a good in an FTZ pushes any required duty payment closer to the time the firm can expect to receive payment for the good once it is sold out of the FTZ. Moreover, if a further processed good includes U.S. domestic components, only the foreign value of the imported inputs is assessed duties when the good is cleared through Customs, unless the good has been transformed enough to be classified under a new tariff line. In the latter case, the duty may be assessed on either the value of the foreign component, or on the finished good. In addition to delaying its tariff payments on the imported inputs for such a good, the company may pay less in duties if the tariff rate on the finished product is lower (“tariff inversion”). (See box ST.2).

Box ST.2: FTZs and Tariff Inversions

Tariff inversion occurs when the tariff on an imported input is higher than the tariff on the corresponding finished good imported for U.S. consumption. For example, a U.S. FTZ manufacturer might produce a sofa at the FTZ into which the firm has imported fabric for upholstery. The fabric might have a tariff of upwards of 10 percent, while the final sofa could be imported duty free.

The final good (the sofa) may be either imported for consumption into the United States or exported abroad. If it is imported into the United States, the U.S. importer can then choose to pay duties either for the original foreign material or on the finished product. In this example, the U.S. importer would choose to pay the zero duty on the sofa, rather than the higher duty to bring the fabric into the U.S. customs territory. And in the event the finished sofa is exported abroad, the entire value of the sofa would be counted as a U.S. domestic export because of the transformation it underwent at the FTZ.

Examples of industries in the United States that use FTZs for tariff inversions include pharmaceuticals; automobiles and automotive parts; upholstered furniture; aerospace products; petroleum production, refining, and petrochemicals; and shipbuilding and repair.a

a USDOC, FTZ Board, “75th Annual Report to Congress,” August 2014; FTZ Corporation, “Relief from Inverted Tariff When Manufacturing” (accessed February 27, 2015).

Foreign-trade zones are the U.S. version of what are often called free trade zones abroad.4 However, U.S. FTZs are substantially more open than other nations’ free trade zones, since U.S. FTZs permit firms both to manufacture goods within their boundaries and to import goods from an FTZ into the U.S. domestic customs territory.5 However, while goods subject to U.S. antidumping or countervailing duties may be admitted into an FTZ, importers cannot use the FTZ to avoid trade remedy duties if the goods are shipped to a U.S. customer.

The majority of goods imported into FTZs are used for further manufacturing or processing and not for re-exports. These further worked products then either enter the U.S. customs territory or are exported, in which case they are classified as U.S. domestic exports. However, two changes in recent years have simplified FTZ use by firms, making the FTZs more practical for distributing goods in the United States or as re-exports.6

First, a new option known as the Alternative Site Framework (ASF) was implemented in 2009. The ASF allows greater flexibility in siting FTZs, a process in which the current location of company facilities is often a key factor for the requestor. The ASF broadly defines a whole area, often all counties within a specific radius of the Customs port of entry limits, so that firms can use their own facilities for FTZ purposes. This expands the availability of single-firm “usage-driven”7 sites, such as BMW’s entire facility in Spartanburg, South Carolina.8 Further, minor boundary modifications of general-purpose “magnet sites”9 are now allowed. This permits more companies to access FTZs at a traditional port of entry location. For example, a firm can use a port FTZ for inventory purposes while also benefitting from its easy access to foreign shipping for re-exports. Additionally, the FTZ application process was overhauled in 2012 to reduce the time and paperwork needed to set up an FTZ. Because of these changes, more firms in the United States are now using FTZs as a key part of their distribution network, helping to eliminate or delay the tariffs that importers pay and improving companies’ transportation efficiency.

Data for re-exports from FTZs offer only limited detail. In 2013,10 total exports from FTZs were over $79 billion (including both re-exports and domestic exports), an increase of nearly $10 billion from 2012 (see table ST.3). This included $18.6 billion (23 percent) of warehoused foreign and domestic goods;11 these are the most likely of the U.S. FTZ goods to become re-exports.

| Item |

2010

|

2011

|

2012

|

2013

|

|---|---|---|---|---|

| Exports from FTZsa | 34.8 | 54.3 | 69.9 | 79.5 |

| Share of total exports | 3% | 4% | 5% | 5% |

a Exports from FTZs include both domestic exports and re-exports (foreign exports). Additionally, these figures only reflect the material inputs and do not include value added during manufacturing.

The main warehouse/distribution industries in FTZs that received foreign inputs in 2013 included vehicles ($24.1 billion), oil/petroleum ($19.1 billion), other electronics ($9.0 billion), textiles/footwear ($8.0 billion), and consumer electronics ($5.8 billion) (see table ST.4).12 Vehicles and oil/petroleum are major manufacturing/refining industries in FTZs, with imports of foreign products processed mostly for eventual domestic U.S. consumption. Electronics are a slightly different story and include both imports for consumption and imports that, after processing, will become domestic exports. A large portion of electronic products that pass through FTZs undergo “kitting”—i.e., assembly and packaging. This is especially true of cellphones, for which the phone and battery will be imported separately, assembled, packaged, and then imported into the U.S. customs territory. Another important FTZ electronics process is semiconductor chip fabrication, such as that performed in Phoenix, Arizona by Intel and Microchip Technology.

| Item |

2010

|

2011

|

2012

|

2013

|

2013 share

|

|---|---|---|---|---|---|

| Vehicles | 10,419 | 11,532 | 16,158 | 24,126 | 29% |

| Oil/petroleum | 4,710 | 36,844 | 29,689 | 19,053 | 23% |

| Other electronics | 1,318 | 2,629 | 2,861 | 8,965 | 11% |

| Textiles/footwear | 1,278 | 2,868 | 3,795 | 7,953 | 10% |

| Consumer electronics | 8,747 | 1,241 | 9,825 | 5,761 | 7% |

| Consumer products | 801 | 2,848 | 3,308 | 4,193 | 5% |

| Electrical machinery | 209 | 916 | 1,190 | 3,530 | 4% |

| Vehicle parts | 2,623 | 4,721 | 1,694 | 2,016 | 2% |

| Other metals/minerals | 3,781 | 916 | 1,184 | 1,163 | 1% |

| Machinery/equipment | 822 | 6,666 | 1,176 | 1,052 | 1% |

| Pharmaceuticals | 533 | 1,213 | 1,007 | 908 | 1% |

| All other | 3,850 | 2,535 | 3,137 | 3,282 | 4% |

| Total | 39,091 | 74,929 | 75,024 | 82,002 | 100% |

Note that in the above examples (vehicle manufacturing, petroleum products, cellphone kitting, and semiconductor chips), none of the goods are considered re-exports if they are eventually exported since they have undergone manufacturing in an FTZ. By contrast, footwear and apparel are imported into FTZs almost entirely for distribution purposes, mostly for the U.S. market. As a result, items exported from FTZs by firms in this industry would be considered re-exports.13

Re-exports

Re-exports may also be called foreign exports or entrepôt trade. They are exported goods that were either (1) merchandise that has been stored at a Customs bonded warehouse or an FTZ, or (2) merchandise that was previously imported for consumption and stored or used in the U.S. customs territory (see figure ST.1). The majority of re-exports are goods that were cleared through Customs as imports for consumption and did not rely on the U.S. FTZ program.

The United States has become an increasingly important part of firms’ regional distribution networks.14 As a result, re-exports have almost doubled as a share of total exports over the last 15 years, rising from 7.3 percent in 1999 to 13.6 percent in 2014. Of the sectors analyzed in part III of this report, footwear, electronics, and textiles/apparel are the top three in terms of re-exports as a share of total sector exports (for examples of types of re-export transactions, see box ST.3).

Box ST.3: Types of U.S. Re-export Transactions:

| Type of re-export transaction | Examples |

|---|---|

| Distribution of new products from abroad through the United States:

1. Duty-free new products imported into the U.S. customs territory but never consumed 2. Duty-paid new products imported into the U.S. customs territory but never consumed (the importer may intend to file a duty drawback) a 3. New products imported as general imports into a bonded warehouse or FTZ, or entered as a temporary importation under bond (TIB) b but never consumed |

Imported goods inventoried domestically and later re-exported, including items such as duty-free machine components, dutiable watches imported from Switzerland and inventoried for later sale in Canada, or a product for a temporary exhibition. |

| Shipment of used goods | Cellphones or clothes that were originally imported into the United States and used by U.S. consumers before being re-exported. |

| Repatriation or transfer of assets | Artwork, gems, or jewelry made abroad, kept in the United States for a time, and then re-exported. |

b All three of these options—importing goods into a bonded warehouse, into an FTZ, or as a TIB —are also known as “duty deferral programs.” This is because the import duty does not need to be paid until the good is imported into the customs territory of the United States. Customs, “Drawback and Duty Deferral Programs” (accessed March 9, 2015).

U.S. re-exports are distributed worldwide, but the primary destinations are Canada and Mexico (see table ST.5). Together these two countries accounted for 44 percent of U.S. re-exports in 2014. Industry representatives largely attribute this to logistics. As the biggest of the three North American markets, the United States is often chosen by firms as a base for their inventory, especially given regulatory efficiencies resulting from NAFTA.15 NAFTA also provides for duty deferral between the three partner countries. This possibility arises when a firm enters a good originating outside of NAFTA into the U.S. customs territory and then re-exports the good to Canada or Mexico. Normally, Customs treats the good as if it had originally been imported for consumption in the United States, requiring the duty to be paid to the United States. However, Customs will reduce or waive the duty (i.e., it will never need to be paid in the United States) if the firm provides evidence of paying the corresponding import duty in Canada or Mexico within 60 days. This option facilitates re-exports to those countries.16

| Item |

2010

|

2011

|

2012

|

2013

|

2014

|

2014 share

|

|---|---|---|---|---|---|---|

| Canada | 42,454 | 47,190 | 47,936 | 49,811 | 49,195 | 22% |

| Mexico | 31,847 | 38,342 | 41,041 | 44,439 | 47,619 | 22% |

| Hong Kong | 7,210 | 8,986 | 9,503 | 10,806 | 13,615 | 6% |

| China | 6,125 | 7,004 | 7,087 | 7,707 | 8,102 | 4% |

| United Kingdom | 4,553 | 5,951 | 6,498 | 6,127 | 7,467 | 3% |

| Israel | 4,794 | 5,875 | 4,537 | 5,910 | 7,179 | 3% |

| Brazil | 2,938 | 4,001 | 4,558 | 4,989 | 6,152 | 3% |

| Belgium | 5,207 | 5,677 | 6,451 | 6,455 | 6,096 | 3% |

| Switzerland | 2,751 | 3,168 | 4,293 | 4,937 | 6,032 | 3% |

| Germany | 3,814 | 4,919 | 5,106 | 5,073 | 5,842 | 3% |

| All other | 44,235 | 51,271 | 56,553 | 61,907 | 63,871 | 29% |

| Total | 155,927 | 182,383 | 193,563 | 208,161 | 221,170 | 100% |

Besides NAFTA countries, re-exports go to a number of other international destinations as well, partly to help businesses distribute goods more efficiently. Rather than maintain marketing offices in each country, a foreign company might keep personnel and a distribution center only in the United States, allowing it to ship its finished product as a re-export regionally when needed.17 In this case, the firm would either accept any U.S. duty it originally paid as a cost of doing business before re-exporting, apply for a U.S. duty drawback, or operate in an FTZ. If the U.S. duty is not high or is zero, a firm may prefer to simply enter the good into the U.S. customs territory and pay any applicable duty rather than bother with the paperwork needed to take advantage of a drawback or FTZ.

The electronics sector had the highest value of re-exports from the United States during 2010–14 (see table ST.6) and accounted for 44 percent of all U.S. re-exports in 2014.18 Of these, computers, peripherals, and parts, together with telecommunications equipment, made up the largest portion (see table ST.7). Although the data do not specify precisely what type of re-exports these goods were, previous Commission work suggests that a significant portion of these may have been used electronics (e.g., cellphones) of foreign origin, either refurbished or exported for disassembly and scrap processing.19

| Item |

2010

|

2011

|

2012

|

2013

|

2014

|

2014 share

|

|---|---|---|---|---|---|---|

| Electronics | 77,098 | 86,588 | 90,657 | 94,057 | 98,416 | 44% |

| Minerals and metals | 18,299 | 24,111 | 23,011 | 27,907 | 31,030 | 14% |

| Transportation equipment | 18,252 | 21,990 | 27,324 | 29,086 | 30,268 | 14% |

| Machinery | 12,962 | 14,785 | 15,977 | 17,180 | 18,552 | 8% |

| Manufactures | 10,173 | 11,711 | 13,451 | 14,094 | 16,926 | 8% |

| Chemicals | 9,983 | 11,342 | 11,378 | 13,044 | 11,810 | 5% |

| Textiles | 4,010 | 4,606 | 4,773 | 5,310 | 5,681 | 3% |

| Agriculture | 2,350 | 2,897 | 3,221 | 3,619 | 3,924 | 2% |

| Energy products | 893 | 2,056 | 1,427 | 1,307 | 1,877 | 1% |

| Forest products | 1,266 | 1,532 | 1,504 | 1,617 | 1,649 | 1% |

| Footwear | 377 | 457 | 509 | 603 | 626 | 0% |

| Special provisions | 264 | 307 | 332 | 336 | 412 | 0% |

| Total | 155,927 | 182,383 | 193,563 | 208,161 | 221,170 | 100% |

| Item |

2010

|

2011

|

2012

|

2013

|

2014

|

2014 share

|

|---|---|---|---|---|---|---|

| Computers, peripherals, and parts | 21,470 | 26,176 | 26,449 | 26,384 | 26,801 | 12% |

| Telecommunications equipment | 13,837 | 16,889 | 18,370 | 19,829 | 21,841 | 10% |

| Natural and synthetic gemstones | 11,612 | 15,601 | 14,554 | 18,594 | 20,868 | 9% |

| Semiconductors and integrated circuits | 15,618 | 14,520 | 14,538 | 15,192 | 14,555 | 7% |

| Aircraft, spacecraft, and related equipment | 5,278 | 5,425 | 8,333 | 9,480 | 10,423 | 5% |

| Medical goods | 5,451 | 5,749 | 6,689 | 7,542 | 7,915 | 4% |

| Certain motor-vehicle parts | 3,963 | 4,945 | 6,252 | 7,269 | 7,111 | 3% |

| Precious jewelry and related articles | 2,130 | 2,876 | 3,942 | 5,102 | 6,038 | 3% |

| Consumer electronics | 5,557 | 6,045 | 6,037 | 5,494 | 5,682 | 3% |

| Works of art and miscellaneous manufactured goods | 3,545 | 3,873 | 4,412 | 3,918 | 5,584 | 3% |

| All other | 67,466 | 80,285 | 83,988 | 89,356 | 94,352 | 43% |

| Total | 155,927 | 182,383 | 193,563 | 208,161 | 221,170 | 100% |

In addition to electronics, natural and synthetic gemstones, including diamonds, also make up a significant share of U.S. re-exports. According to an industry representative, while many diamonds that are shipped by air for U.S. delivery may be re-exported after arrival in the United States, others may never actually enter the United States; instead, they may be rerouted mid-flight to a non-U.S. destination if a foreign buyer is found by the dealer. If this occurs, the dealer will file export documentation even though the good was never physically imported into the United States. This applies to an unknown quantity of the re-exported diamonds (see the Minerals and Metals section of this report for more information).20

Trade Measures and the Effects of FTZs and Re-exports

As U.S. trade has evolved, the categories used to measure trade as originally developed have moved away from some of the distinctions that existed in the past. To begin with, “U.S. imports for consumption” is the metric that describes goods that have entered the U.S. customs territory with any required duties paid. In the past, when U.S. import tariffs were higher and applied to more goods, it could be assumed that the great majority of this merchandise was consumed in the U.S. customs territory.

However, companies increasingly rely on re-exports from imports for consumption to facilitate international distribution, blurring the distinction between U.S. general imports and imports for consumption. Low U.S. tariffs, cheaper international transportation costs, regional integration measures, and the streamlining and modernization of Customs regulatory procedures have all contributed to this trend. Further, FTZs and the import-reporting requirements complicate the data on imports for consumption. For example, an importer that takes advantage of a tariff inversion (see box ST.2) does not need to report the originally imported foreign good as an import for consumption. Rather, the importer can report the lower-duty, U.S. value-added manufacture as an import instead. This situation may lead analysts to incorrectly label a final good manufactured by a U.S. firm as an import from abroad.

Wider occurrence of re-exports also muddies the export data picture. In recent years, re-exports have accounted for an increasing share of total exports, particularly in sectors such as electronics, footwear, and textiles and apparel. These sectors represent a significant portion of U.S. business and illustrate the importance of the United States in certain supply chains, particularly regional networks.

Given these developments, 2014 Trade Shifts has moved its analysis from the imports for consumption series to the general U.S. imports series. It uses domestic exports to specifically describe sectoral trade and exports of U.S.-produced goods, but total exports to examine national exports.

Conclusion

U.S. general imports are a more stable metric for examining U.S. imports than imports for consumption, given the growing value of re-exported goods that have previously entered the U.S. customs territory and the inherent variations in the U.S. “imports for consumption” data series resulting from the U.S. FTZ program. Given the recent modifications to the U.S. FTZ program and its increasing appeal for importers, re-exports from these locations may well continue to increase. Additionally, using both U.S. domestic exports and re-exports in an analysis allows a more in-depth view of U.S. trade.

1 U.S. Harmonized Tariff Schedule numbers are used to categorize U.S. imports, while U.S. schedule B numbers classify U.S. exports”

2 Duty-free merchandise that is below $2,000 in value requires no entry formalities, and the U.S. postal service can collect any required duties on dutiable merchandise below this value for Customs. U.S. export data are only collected for shipments valued above $2,500. USDOC, Census webpage, https://aesdirect.census.gov/ (accessed March 6, 2015); USDOC, Customs, “Importing into the United States,” 2006, 15; FedEx, “Fedex Export Agent File,” https://images.fedex.com/gtm/pdf/FXEF008.pdf (accessed March 6, 2015).

3 USDOC, FTZ Board, “75th Annual Report to Congress,” August 2014, 6.

4 Customs, “About Foreign-Trade Zones and Contact Info” (accessed March 6, 2015).

5 Other countries’ free trade zones may only permit re-exportation, or allow importation but not manufacturing within the zone. FTZ Corporation, “The Foreign-Trade Zone Corporation Can Assist You” (accessed February 27, 2015).

6 U.S. government official, telephone interview by USITC staff, March 4, 2015; industry representatives, telephone interview by USITC staff, March 3, 2015.

7 Usage-driven sites, or subzones, are areas of a magnet site approved for a specific company and use. Through ASF, usage-driven sites may be developed faster and may be located at companies’ facilities. USDOC, FTZ Board, “Alternative FTZ Site Framework: Introduction for CBP” (accessed March 25, 2015); USDOC, FTZ Board website, http://enforcement.trade.gov/ftzpage/info/zonetypes.html (accessed February 27, 2015).

8 USDOC, FTZ Board,”Enforcement and Compliance,” http://enforcement.trade.gov/ftzpage/admin/bmw.html (accessed June 8, 2015).

9 Magnet sites are generally industrial parks or port facilities designated by the FTZ Board and are intended for multiple users. These are similar to traditional FTZ sites but do not operate under the previous traditional site-management framework, which reportedly had a burdensome application process. Further, it was noted that these sites were also sometimes used for speculative purposes—i.e., they were not built for a particular use but rather to attract business users, who may or may not have materialized. USDOC, FTZ Board, “Alternative FTZ Site Framework: Introduction for CBP” (accessed March 25, 2015); USDOC, FTZ Board website, http://enforcement.trade.gov/ftzpage/info/zonetypes.html (accessed February 27, 2015).

10 The latest year with available FTZ statistics is 2013. The FTZ Board report is generally sent to Congress in August for the preceding year. USDOC, FTZ Board, “75th Annual Report to Congress,” August 2014; U.S. government official, telephone interview by USITC staff, March 4, 2015.

11 These FTZ export data do not differentiate between goods produced in the United States and foreign-origin items that have been entered for U.S. consumption before being admitted to an FTZ. In other words, these are statistics from the perspective of the firms that operate in an FTZ and not FTZ program data

12 USDOC, FTZ Board, “75th Annual Report to Congress,” August 2014.

13 Industry representatives, telephone interviews by USITC staff, February 27 and March 3, 2015.

14 Telephone interview with industry representatives, March 3, 2015

15 Industry and U.S. government representatives, telephone interviews with USITC staff, February 27, 2015, and March 3, 2015.

16 Customs, “Drawback and Duty Deferral Programs” (accessed March 9, 2015). Note that this merchandise will have been reported as a U.S. import for consumption solely because it has cleared through Customs at the time of entry, even if the importer had no intention of selling the goods to a U.S. customer.

17 Industry representative, telephone interview by USITC staff, February 27, 2015.

18 Electronics also had a high share of re-exports to total exports. Altogether, 37 percent of total exports in the electronics sector were re-exports. For more information, see the Electronic Products webpage.

19 USITC, Used Electronic Products, February 2013, xi.

20 Industry representatives, telephone interview by USITC staff, March 19, 2015.