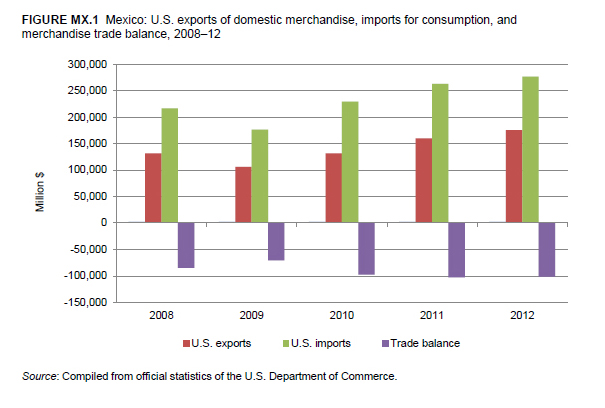

Change in 2012 from 2011:

- U.S. trade deficit: Decreased by $1.5 billion (2 percent) to $101.2 billion

- U.S. exports: Increased by $15.2 billion (10 percent) to $175.2 billion

- U.S. imports: Increased by $13.7 billion (5 percent) to $276.4 billion

The U.S. merchandise trade deficit with Mexico decreased by $1.5 billion (2 percent) to $101.2 billion in 2012, as increased exports outpaced import growth (figure MX.1). Transportation equipment and electronic products continued to account for the majority of trade with Mexico in 2012 (24 percent and 19 percent, respectively).

U.S. exports to Mexico, the third largest individual U.S. trading partner (after Canada and China), increased by $15.2 billion (10 percent) to $175.2 billion in 2012, principally as a result of increased exports of transportation equipment (particularly motor vehicle parts) and chemicals and related products. Minerals and metals and electronic products were other major sectors with increasing exports to Mexico.

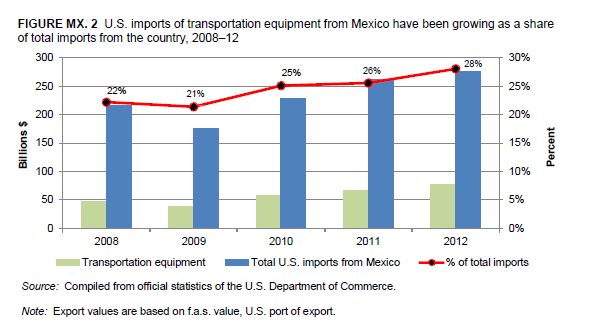

U.S. imports from Mexico increased by $13.7 billion (5 percent) to $276.4 billion, owing to increased imports of transportation equipment (specifically motor vehicles and certain motor vehicle parts) (figure MX.2), and electronic products especially computers and peripherals and consumer electronics. The overall expansion of U.S. imports from Mexico was somewhat offset by a $5.1 billion drop in imports from the energy-related products sector.

U.S. Exports

In 2012, U.S. exports to Mexico increased in eight of the nine sectors discussed in this report, with transportation equipment and chemicals and related products representing the largest categories of growth. The widespread growth of U.S. exports to Mexico likely reflected Mexico's burgeoning economy; the country's gross domestic product (GDP) expanded by 3.8 percent in 2012, a rate exceeding the United States' 2.2 percent growth.

Transportation equipment, which was the largest U.S. export sector to Mexico in 2012, grew by $4.1 billion. Exports of motor vehicle parts fueled one-quarter of this sector’s growth, stemming from greater demand from vehicle manufacturers in Mexico. The country is growing in importance as a vehicle production platform, a role that is driving Mexico’s demand for associated parts. For example, motor vehicle parts accounted for over 40 percent of U.S. exports of transportation equipment to Mexico in 2012. This trend also reflects the integration of the North American motor vehicle industry.

U.S. exports of transportation equipment were also buoyed by growth in exports of aircraft, spacecraft, and related equipment and of construction and mining equipment. Virtually all of the increase in exports of aircraft, spacecraft, and related equipment was of civilian aircraft, engines, and equipment. Although greater detail is unavailable, the increase in exports of parts and engines could be partly attributed to new aircraft production plants in Mexico for Learjet, Cessna, and other aircraft companies. Increased U.S. exports of construction and mining equipment are likely the result of a new emphasis by Mexico on building up infrastructure to increase its competitiveness.

Much of the $3.0 billion increase in exports within the chemicals and related products sector can be attributed to exports of miscellaneous plastic products, which grew by $672 million (11 percent) and accounted for 16 percent of sector exports. Since this product grouping covers a wide variety of products, it is difficult to attribute increased U.S. exports to factors more specific than a general improvement in the Mexican economy.

U.S. Imports

The largest absolute increases in imports from Mexico in 2012 were of transportation equipment and electronic products. The majority of the transportation equipment sector’s growth was due to increased U.S. motor vehicle imports. During 2012, demand for passenger vehicles in the U.S. market grew by 14 percent, reflecting both greater availability of credit to finance these goods and a resurgence of spending following widespread consumer restraint during the economic recession of 2008-09.

As previously discussed, Mexico has become a popular manufacturing destination for multinational firms seeking to lower production costs and export to large markets, such as the United States. Mexico’s participation in several free trade agreements, including the North American Free Trade Agreement (NAFTA), has also increased the attractiveness of the country as a motor vehicle manufacturing hub. Vehicle manufacturers headquartered in the United States, Asia, and Europe commonly produce in Mexico, taking advantage of lower costs, and then export duty free into the United States and other countries. Motor vehicle production in Mexico grew by 13 percent in 2012 to 2.9 million units.

U.S. imports of certain motor-vehicle parts from Mexico grew by 16 percent, as Mexico continued to be the leading U.S. supplier of these inputs. U.S. import growth from Mexico for this subgroup reflects, in large part, the integration of the motor vehicle industry in North America owing to NAFTA. The growth in imports from Mexico was likely driven by increased U.S. motor vehicle output in response to improved consumer demand and increased credit availability, as previously discussed. U.S. motor vehicle production rose to 10.3 million units in 2012, up 19 percent from the 2011 total of 8.7 million units.

Investment in the Mexican auto parts industry has also increased, as Asian auto parts producers, for example, have expanded capacity in Mexico to supply their motor vehicle manufacturing customers that have moved there. This shift to Mexico is partly in response to the strong Japanese yen, which has made Mexico more attractive to Japanese producers, and partly due to an effort by these producers to take advantage of Mexico’s duty-free access to major markets, including Brazil, the United States, and the European Union, through various free trade agreements. European parts suppliers are also investing in Mexico, with the goal to develop a supply base for both North and South America. As a result, Mexican auto parts production has risen steadily over the last three years, with the value of total production reaching $75 million in 2012. The sector is export oriented and strongly tied to U.S. motor vehicle demand.

The second largest U.S. import category from Mexico in 2012 was electronic products, which reached $65.3 billion after growing by $3.3 billion. Within this sector, imports of computers and peripherals increased by $1.5 billion, or 10 percent. The majority of the increase was in imports of disk drives not entered with systems.

U.S. imports of consumer electronics from Mexico, which grew by $1.1 billion (7 percent), also drove much of the expansion of electronic products imports. Most of this increase was for set-top boxes, which reflected heightened demand for units more capable of streaming information and providing video-on-demand services.

Energy-related products is the only major sector in which U.S. imports from Mexico declined, falling $5.1 billion (or by 12 percent) from $44.5 billion to $39.4 billion in 2012. Crude petroleum accounted for most of this reduction, as the value of U.S. imports from Mexico decreased by $18.0 billion (7 percent) to $228.9 billion, and the volume of U.S. imports decreased by 46.3 million barrels (12 percent) to 355.7 million barrels. The price of U.S. imports of crude petroleum from Mexico increased by only $1 per barrel to $102 in 2012. The decrease in demand for imports of crude petroleum is likely due to higher U.S. production as well as decreased Mexican oil production, which has fallen each year since 2006. U.S. imports of petroleum products from Mexico also fell, from 38.2 million barrels in 2011 to 21.6 million barrels in 2012 as a result of the mild 2011-12 winter, which reduced demand for imports of distillate and residual fuel oils used for heating.