Frequently Asked Questions (FAQS) about Tariff Classification, the Harmonized Tariff Schedule, Importing, and Exporting

Help! I need to find a Tariff Classification Code or Duty Rate!

The HTS is not a list of all products in trade, but a system of categories that classifies imported products, including new or “concept” products. To help ensure consistent duty treatment, there are legal rules and notes that help define these categories, as well as CBP rulings based on importer questions and past entries.

Sometimes products are named in the Harmonized Tariff Schedule (HTS) using common terms and can be found if you search for the name, such as “toaster” (8516.72.0000) or “electric toothbrush” (8509.80.5045). But, other times, a search for a seemingly common item such as “phone charger” results in “No matching results found.” This happens when the product you’re searching for is not described the way that you searched for it (for instance, phone chargers are listed as “static converters for telecommunication devices”). In other cases, searching for a common word such as “shirt” returns too many results to be useful.

Sometimes the HTS search can return a small number of results, none of which may be correct. Consider searching for a kitchen paring knife with a ceramic blade. Using the word “knives” produces more than 20 results, many of which are in heading 8211 (“Knives with cutting blades, serrated or not, …”). That result seems reasonable, but the beginning of Chapter 82 explicitly excludes articles with ceramic blades and says the proper classification for ceramic knives is Chapter 69 as an article of ceramics. That is why it’s important to read the notes for each section – so you can properly identify your products.

Remember, the HTS is organized as a hierarchy (beginning with headings at the broadest descriptive level, each of which can be divided into subheadings with more specific coverage). There are currently more than 1,220 four-digit headings in the HTS. Most categories cover a range of products described in more general terms, and based on the predominant material from which they are made. In these cases, specific products may not be described by name and are not found by a keyword search alone (as with “phone charger” above). And, in most cases, the last subheading in a heading merely says “Other” to refer to things which fall in this heading but are not named in other subheadings.

To avoid these kinds of pitfalls, it is best practice to avoid relying on the HTS search tool alone and consult the legal text of the HTS itself after you do a search. For an example of how to classify a product in the HTS, see the following question.

The HTS classifies products using the general rules of interpretation (GRI), additional U.S. rules of interpretation (found at the beginning of the HTS), and the appropriate legal descriptions and notes in chapters one through 97. A key concept in determining product classification is to start at the top: find the most specific four-digit heading that describes your product, then look only at the subheadings under that heading. Our common analogy is to a pinball game, in which winning the game can happen only if your ball is in the right path initially. This answer is written to be independent of the HTS search tool.

Example: Find the classification of a purebred dog being imported for breeding.

Step 1: Find the four-digit heading describing the product. Start in the table of contents. Chapter 1, is “Live Animals.” (Note that according to GRI 1, some provisions in the tariff schedule, e.g., chapter titles, are useful to help you find appropriate headings, but these titles have no legal significance.)

Step 2: Read and compare the descriptions at the four-digit heading level, until you decide which one best covers your product.

This process requires some reasoning. For example, a search for “purebred” leads you to 0101.10 “Purebred breeding animals.” However, the 4-digit heading for that result is 0101 (“Live horses, asses, mules and hinnies”). So, subheading 0101.10 only relates to purebred equines – not dogs.

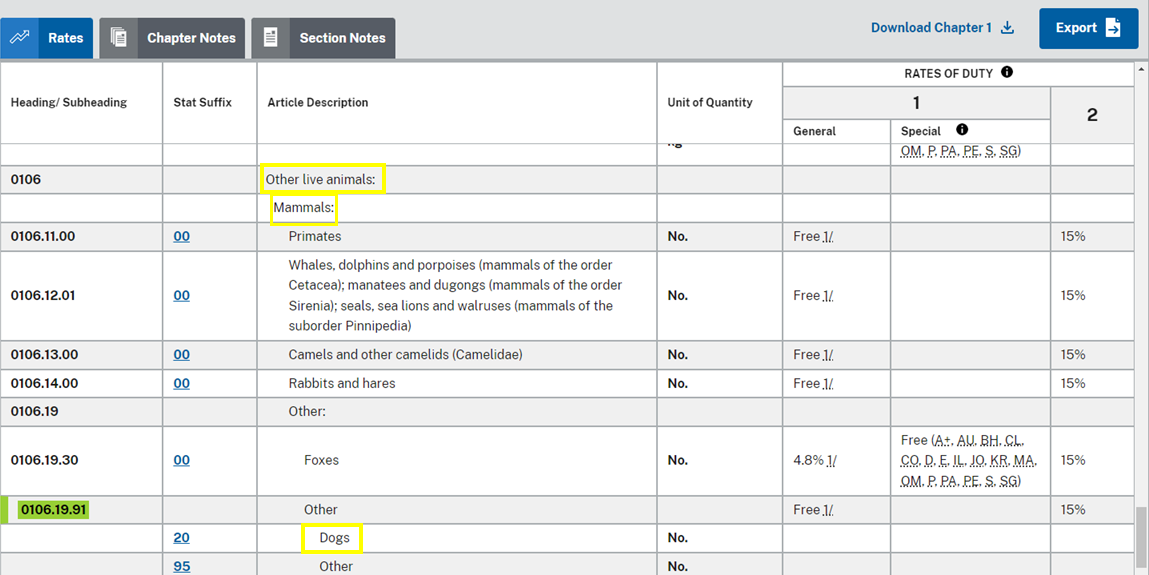

Step 3: “Dogs” are not specifically named in any of the four-digit headings in chapter one, but they are described by the category “other live animals” (heading 0106). This heading is a residual or basket category, which includes everything that hasn’t been named in the headings before it (headings 0101 through 0105).

Note: If a product is comparably described by more than one four-digit heading, whether in one chapter or across multiple chapters, check relevant section and chapter notes for definitions or exclusions. They may eliminate some four-digit headings or direct you to the correct one. If necessary, apply GRI's to decide which of the remaining four-digit headings applies.

Step 4: After selecting the appropriate four-digit heading, compare the subheadings’ descriptive texts that appear at the first level of indentation under that heading to find the most specific category (in this case, “mammals”). Then compare all the descriptions at the second level of indentation within that provision, and so forth. In the table below, the last 8-digit subheading (0106.19.91) is the provision which would determine any duty you would owe, but you would report all 10 digits (0106.19.9120) on your entry.

Note that goods are classified in the provisions of chapters 1 through 97, although many shipments may be eligible for different duty treatment under U.S. chapters 98 or 99 on proper documentation.

You have several options:

- Search the Customs Rulings Online Search System (CROSS) database. CROSS may include words more commonly used to describe a product, such as “phone charger”— if U.S. Customs and Border Protection (CBP) has mentioned the searched term in a ruling.

- Once you find a potential HTS classification in CROSS, return to HTS and enter that classification number in the search bar (for instance, for a phone charger, it’s 8504.40.8500). HTS will take you directly to that HTS number and show you the rate of duty for that product.

- Contact the Customs Center of Excellence and Expertise for your product (just search for that phrase) or the port of entry through which your items will be imported into the United States. If possible, talk to an import specialist for informal classification assistance. These centers have staff teams and a directory to help you contact the right team but be advised that such classification assistance is informal and therefore not binding on CBP. For a directory of ports and contact information, click here. Be prepared to list the different parts of your product, materials from which it is made, and how it functions.

- You can request a binding electronic ruling from CBP if you follow the guidance provided here.

- Fill out a form here and the USITC can provide informal guidance and assistance regarding your HTS questions. This is not binding advice but can assist you in talking to CBP staff.

Making Sense of the HTS

The first column titled “Headings/Subheadings” contains the 4-digit, 6-digit and 8-digit numbers assigned to each class of goods. The 4- and 6-digit provisions are part of the international Harmonized System, while the 8- and 10-digit provisions are unique to the United States. Chapters 98 and 99 are different because the provisions there do not appear in the schedules of other countries.

The 4-digit number is a “heading,” and the 6-digit and 8-digit numbers are “subheadings.” The legal text of the HTS ends at the 8-digit level, which is where tariff rates are assigned. If the language in the “article description” column is not indented, you’re looking at a heading, regardless of how many zeroes are added after the first 4 digits. The indented provisions under a heading must be narrower in scope than the heading’s text, and the subordinate provisions cannot broaden the meaning of the 4-digit heading’s text.

The second column is titled “Stat. Suffix” for “Statistical Suffix.” Some tariff rate lines are subdivided to further narrow classes of products. This subdivision adds two more digits the end of the 8-digit legal provision’s number. (Note that those digits are zeroes if no such statistical categories have been adopted.) All products falling within the 10-digit statistical-reporting numbers of a particular 8-digit legal provision receive the same duty rate as the 8-digit provision.

The third column is titled “Article Description.” This column describes the goods falling under each heading, subheading, and statistical-reporting number. These descriptions are broadest in coverage at the 4-digit heading level, and if subheadings or statistical reporting numbers do appear below a heading their combined coverage must equal that of the heading.

The fourth column is titled “Unit of Quantity.” This is the unit of measure for reporting goods. In some instances, two or three different units must be reported – such as the total number of items and the total weight in kilograms. The second unit of quantity is frequently used to measure against import regulations (e.g., for determining quotas).

The final three columns appear together under a superior column titled “Rates of Duty.” Rates of duty for the subheadings are in column 1-general, column 1-special, and column 2.

Column 1- general identifies the rates for countries that have trade agreements, generally under the World Trade Organization, or are entitled to most favored nation treatment, known in the United States as normal trade relations (NTR) status. Almost all countries of the world are eligible to receive these duty rates.

Countries being given column 1-special duty rates must all be eligible for general or NTR duty rates. Column 1- special identifies lower-than-general or duty-free rates for products under free trade agreements (such as USMCA), preference programs (such as GSP), or statutes. Beside the special rate is a list of all programs eligible for that rate when the items meet particular criteria listed in general notes and when the importer claims it for each shipment. When an importer fails to claim a special duty rate, or where no special rate of duty is provided for a subheading, the rate of duty in column 1- general applies.

Rates of duty in column 2 apply to products of countries listed in HTS general note 3(b)—at the time this document was posted these countries are: Belarus, Cuba, North Korea, and Russia.

The general rules of interpretation, section, chapter, and subheading notes (including those labeled “Additional U.S. Notes”), and the terms of the headings and subheadings constitute the legal text of the HTS. The titles of sections, chapters and subchapters are provided for ease of reference only and have no legal significance. Similarly, endnotes referring to other HTS codes (for example, “See 9903.88.01”) are provided for ease of reference and have no legal significance. You may also notice additional documents such as the China Tariff Guidance document here (PDF). As with the endnotes, these documents are provided for ease of reference and are not part of the legal text of the HTS.

Statistical Reporting Numbers are not legal but are important in gathering trade data. The 10-digit number for each imported good (its 8-digit subheading plus the statistical suffix) must be used on entries. However, the stat suffixes, the statistical-level descriptions, and the units of quantity are administratively adopted rather than being enacted. See the second part of the Preface to each annual or Basic Edition of the HTS for more information.

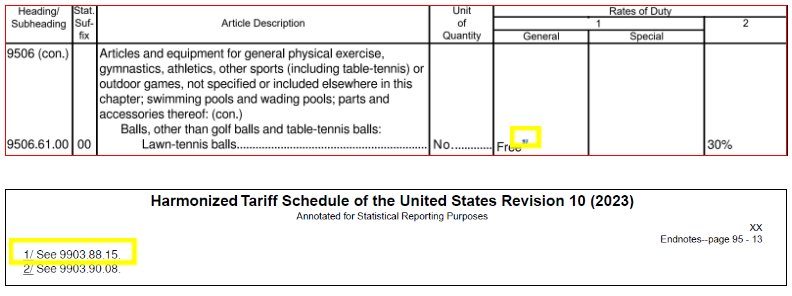

Endnotes and footnotes are there for ease of reference—included to assist you in referencing other applicable areas of the HTS for your goods.

Endnotes are found in chapters 01 – 97 and are in the Stat Suffix, Article Description, Unit of Quantity, or Rates of Duty columns. Each endnote, regardless of location, refers you to another part of the HTS where additional information for your goods can be found. Footnotes found in chapters 98 - 99 and the general notes are merely informational. Their presence or absence has no legal effect, and the language contained in footnotes has no effect on the legal text or its interpretation. Compiler’s notes are also added to provide information to users of the HTS, especially where provisions have expired or may not have been updated.

Endnotes in the Stat Suffix column refer you to guidance for not only your original HTS classification number, but any other supplemental or additional HTS number(s).

Endnotes in the Article Description column (regardless of whether they are at the legal or statistical level) refer you to information indicating whether or not your product qualifies for an exclusion from additional duties.

Endnotes in the Unit of Quantity column refer you to additional guidance on reporting units of quantity.

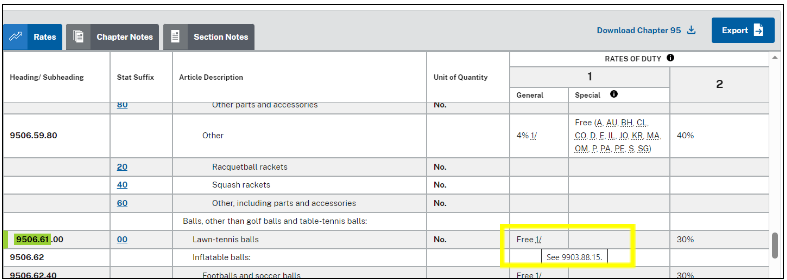

Endnotes in the Rates of Duty columns refer you to additional rates of duty for your product.

When viewing the HTS code in PDF form, click on the endnote to go to the end of the chapter. Using the example below for lawn tennis balls, endnote “1/” links you to “See 9903.88.15.”

When viewing the HTS code using the HTS search tool, placing your cursor over the endnote shows the additional reference for your searched item.

Previous editions of the HTS are available starting from 1989 (the first year of publication) on the Harmonized Tariff Schedule Archive page.

Each edition of the HTS includes a change record listing major changes since the previous edition.

Importing Basics

While the first six-digits of a code are “harmonized” internationally, any digits coming after the first six (for example, the remaining 4 digits at the end of the HTS code in the U.S.) and their product descriptions can be unique to a particular country. For example, blenders are classified in subheading 8509.40.00 (statistical reporting number 8509.40.0015) in the HTS, but in China the code is 8509.40.9000. Notice the first six digits (8509.40) are identical and the remaining four digits are different. Also, each country chooses its own duty rates. So, your foreign supplier may provide a tariff code, but it could be from the country of export and not be the same as the appropriate HTS number.

The USITC provides a helpful table (PDF) that lists the HTS subheadings in chapters 01 through 97 that are covered by the additional tariffs on products of China and the applicable HTS heading in subchapter III of chapter 99 where the additional tariff is provided for. Further information about China 301 tariffs and exclusions can be found at this USTR website. Note that this table is not a part of the HTS itself and should not be relied upon as an authoritative source. See question titled “How does the HTS use Endnotes, Footnotes and Compiler’s Notes?” under “Making Sense of the HTS”.

For other additional duties including the Section 201 tariffs on solar cells and panels and Section 232 tariffs on aluminum and steel, see this CBP website.

There is no legal requirement for you to hire a customs broker to clear your goods. However, many importers opt to do so. Customs brokers are licensed by U.S. Customs and Border Protection (CBP). Importers are ultimately responsible for knowing CBP requirements and ensuring their importation complies with all federal rules and regulations.

A list of customs brokers can be found on the CBP.gov website under the “Ports” section by clicking on the state/port of entry you intend to import through. To find a customs broker, please go “Find a Permitted Broker".

If you choose to file your own customs entry, please read CBP’s publication Importing into the United States for an overview of what is involved.

Refer to this CBP website about bonds.

Exporting Basics

No. Exports are classified using Schedule B from the Bureau of the Census, which can be viewed here. Like the HTS, Schedule B is based on the harmonized system, so in most cases the code is very similar. So much so in fact, that the general statistical notes (PDF) and the notice to exporters (PDF) of the HTS lists the instances where the HTS and Schedule B differ. For exports listed in the notice, Schedule B must be used instead of the HTS for reporting shipments.

The United States does not assess tariffs on U.S. exports. Additionally, about 95 percent of items exported from the U.S. don’t require an export license. All exporters must perform due diligence regarding all transactions. Check out the Department of Commerce’s export licensing information here and its Export Solutions website here.

Miscellaneous

Antidumping and countervailing duties (AD/CVD) are not ordinary customs tariffs and are not in the HTS. Although the USITC has a role in AD/CVD investigations (https://www.usitc.gov/investigations/import_injury), the International Trade Administration (ITA) of the Department of Commerce sets the rates of these additional duties in AD/CVD orders.

CBP maintains a public database of many (but not all) instructions implementing AD/CVD orders at: https://aceservices.cbp.dhs.gov/adcvdweb. These instructions contain information on rates of duty and contact information at the ITA for further information. Questions about the scope of AD/CVD orders should be referred to the contacts in the instructions or to "Contact Enforcement and Compliance" at https://www.trade.gov/enforcement/operations.

The two sites linked below can be used to find the Department of Commerce AD/CVD case number.

- A report of AD/CVD orders in effect on the date of update can be found using the ITA Listing of AD/CVD Orders

- For recent or ongoing investigations, see https://www.usitc.gov/investigations/import_injury